Report on individual line-items from Sales Invoices and Credit Notes with this report. Get useful insight into your business product and services (aka Inventory Items), projects, taxes and more.

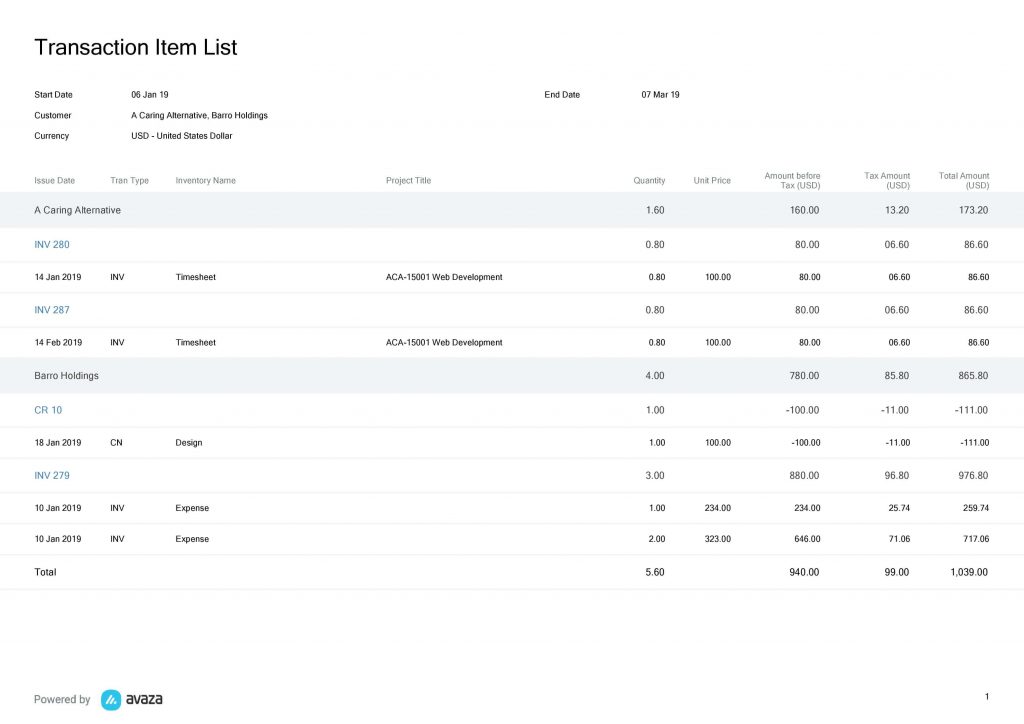

Figure: Transaction Item List Report Grouped by Customer and Transaction Number

A few reasons to use this report:

- Review key information for each product / service such as total discount amount, quantity, cost, sale and margin amount.

- Group line items by Project to report on total project revenue and amount payable by customer.

- Group line items by Tax Code to see the total per tax code for the entire business. Really hand at tax time.

- Export the line items to external systems for record keeping & analysis.

Report Parameters

While this report runs by default for the last 30 days, it is highly customizable and you can choose from multiple groupings, filters and column options, along with other useful report parameters.

Report Currency

Choose which currency you wish to see the data reported in. You can choose between the base (account) currency or the customer currency. This will display the Amount Before Tax, Tax Amount, Total Amount and Balance columns in the Customer Currency or the Account currency based on your selection.

Learn more about how we convert invoices in a currency different than account base currency into base currency.

Date Range:

The following pre-defined date range options are available.

- This Week

- This Month

- Last Week

- Last Month

- Last 30 Days (default)

- Last 60 days

- Last 90 days

- Custom Date Range (allows you to choose a custom date range in the next parameter)

Start Date – End Date

Enter a custom date range to run the Transaction Item List report for.

Transaction Type: Filter the transactions you want to report on. Options include Credit Notes and Sales Invoices.

Groupings:

Many of our reports allow you to group data. The Transaction Item List Report has two available grouping options:

- Primary Grouping

- Secondary Grouping

These groupings include the following options:

- Inventory Item

- Tax Name

- Project

- Transaction Number: This is the Invoice or Credit Note number.

- Customer

- Tran Type (includes Invoices and Credit Note)

- Status (includes statuses for all transaction types)

- Recurring Profile Name (group invoices created by a recurring invoice profile)

Note: We subtotal the Quantity, Cost Amount, Discount Amount, Amount Before Tax, Tax Amount, Total Amount, Margin and Balance amounts when data is grouped. If you have chosen to display the report in Customer Currency, and the chosen grouping has multiple currencies, then we will display N/A as amounts from different currencies can’t be added up.

Customer: Select the customer(s) you want to run the report for. You can select one or more customers as needed.

Projects: Select the project(s) you want to run the report for. You can select one or more projects as needed. You can only choose a project after one or more customers have been chosen.

Inventory Items: Filter the report based on Inventory Items

Tax Names: Filter the report based on Tax Names

Status: Filter transactions based on their status. Options include Closed, Draft, Late, Open, Paid, Partially Paid, Sent and Void.

Recurring Profile Name: Filter the report based on Recurring Invoice profile names.

Show Columns

- Description

- Inventory Name (default)

- Quantity (default)

- Unit Price (default)

- Cost Price: As entered for each Inventory Item in Cost Price field when creating or editing an Inventory Item.

- Cost Amount: Cost Price multiplied by Quantity.

- Project Title

- Tax Name

- Subject

- PO Number

- Due Date

- Recurring Profile Name

- Transaction Type (default)

- Status

- Discount Amount.

- Issue Date (default)

- Transaction Number (default)

- Amount Before Tax (default). Read more about how we calculate this here.

- Tax Amount (default). Read more about how we calculate this here.

- Total Amount (default). Read more about how we calculate this here.

- Margin: This is the Line Item Amount before tax minus cost amount. (where cost amount is inventory item cost price x quantity)

- Balance Amount. This is the (Line Item Amount / Transaction Total Amount) x Transaction Balance. Here’s an example:

Invoice Amount: $100 USD

Payment applied: $40 USD

Invoice Balance: $60 USD

Line Item 1 Amount: $50 USD

Line Item 1 % of total transaction: $50 / $100 = 50%

Line Item Balance = $60 * .5 = $30 USD

Line Item 2 Amount: $25 USD

Line Item 2 % of total transaction: $25/$100 = 25%

Line Item Balance = $60 * .25 = $15 USD

Line Item 3 Amount: $25 USD

Line Item 3 % of total transaction: $25/$100 = 25%

Line Item Balance = $60 * .25 = $15 USD

Do you need any more help with the Transaction Item List report? Feel free to contact our support team via chat or email.