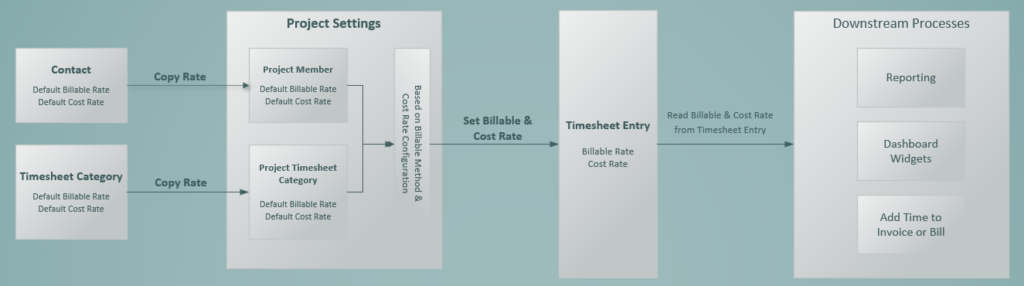

Avaza has support for configuring both Billable & Cost rate that applies to timesheet entries. Both the Billable & Cost rates can be configured for contacts and or timesheet categories. These configured values are copied across to the project and can be updated on the project by project basis.

Based on the Project Billable Method, the appropriate configured Billable Rate is copied across to the timesheet when created or edited. The Cost Rate is also copied across to the timesheet based on its configuration on the Project Settings page. All our reports, dashboard widgets, and other processes that need to fetch the timesheet cost or billable rate fetch it from the timesheet record itself.

The Billable & Cost Rate values are only visible to users with the role of Project Manager, Finance Manager, or Admin.

Cost Rates

Cost rates equate to the cost you incur for having that team member work on a project. These are used in reports to help you optimize the performance of your business. One such report would be the Project Summary Report or the Project Profit Margin Analysis report.

User Cost Rates

Each user can have an hourly cost rate entered for them under Contacts. This cost rate can be updated for each project by going to Project Settings > Project Member > Cost Rate.

Timesheet Category Cost Rates

Each timesheet category can have an hourly cost rate entered for it under Settings > Timesheet Settings. This cost rate can be updated for each project by going to Project Settings > Timesheet Categories > Edit category cost rate.

When calculating Timesheet Costs, we prioritize the Timesheet Category Cost Rate over the Person Cost Rate. If you would prefer to use use the Person Cost Rate, then do not enter a cost rate for Timesheet Categories on that project.

Billable Rates

Billable rates, referred to simply as “Rates” in the app, are the rate that is invoiced to your client. John may have a rate of $200/hour or you may be charging $40/hour for each hour of editing.

We use billable rates only when an appropriate billing method has been selected.

UserBillable Rates

User-level billable rates are used for invoicing when the Billing Method is set to Person Hourly Rate.

Enter a billable rate for each user under Contacts, or update it for a specific project by opening the Project Settings page > editing the Team Member.

Timesheet Category Billable Rates

Timesheet Category-level billable rates are used for invoicing when the Billing Method is set to Category Hourly Rate.

Enter a billable rate for each timesheet category under Settings > Timesheet Settings, or update it for a specific project by opening the Project Settings page > editing the timesheet category.

Updating Cost or Billable Rate on Project Settings Page

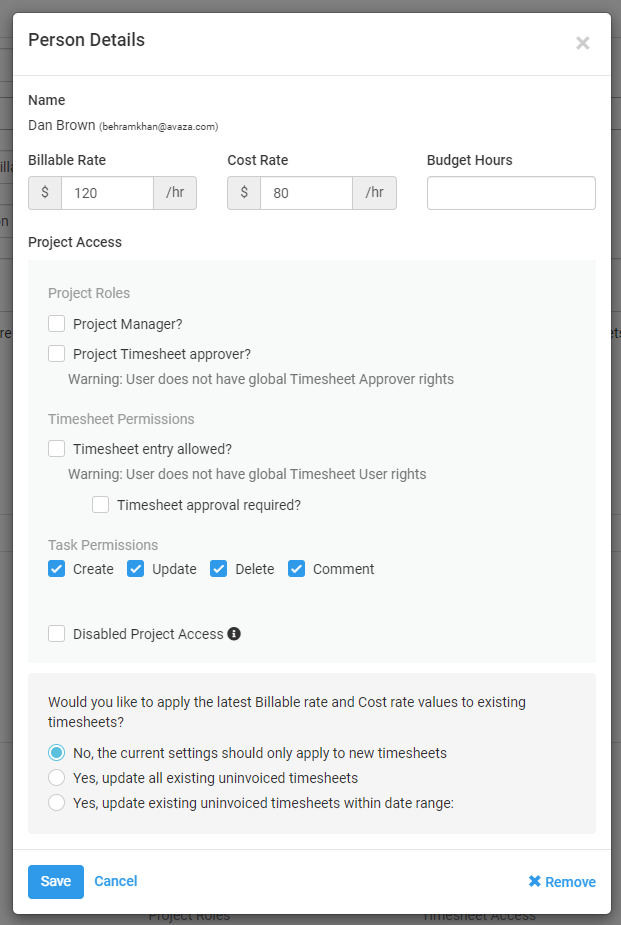

When updating either User Rate or Category rate on a project you are presented with the following three options.

- No, the current settings should only apply to new timesheets. This option will apply the updated rates only to newly created timesheets or any timesheets that are edited after the rate is updated.

- Yes, update all existing uninvoiced timesheets. This option will update the Cost & Billable rate on all existing uninvoiced timesheets. This option is useful if you will like the new rate to apply to existing timesheets that are not yet invoiced and all newly created timesheets.

- Yes, update existing uninvoiced timesheets within date range. This option will apply the new rates to uninvoiced timesheets for only the specified date range and all future timesheets.

Please note that if the project Billing Method is updated then based on the newly selected Billing Method all uninvoiced timesheet Billable rate will be updated upon Save.

Do you need more help with billing/cost rates? Feel free to contact our support team via chat, or email.